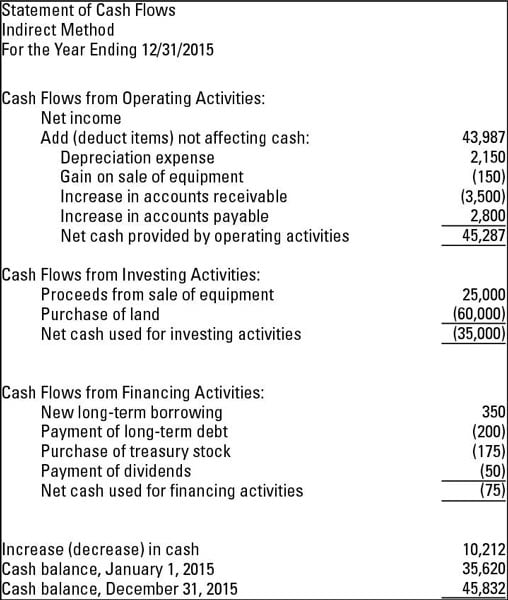

On the last lines of the statement, consider writing down the cash balance at the beginning (the “opening”), adjust it as per company net increases or decreases, and then write down the cash balance at the end (the “closing”), which is the adjusted figure. When you add up the totals from the company’s operating, investment, and financing sections, you will get an estimate of the net growth or reduction in cash that the business experienced. You Can Calculate the Net Increase or Decrease: To determine the amount of net cash generated by the firm’s operations during the period, proceed to the next section, and you can proceed to either add or remove the various steps the company took to fund those operations.ĩ. To determine the amount of net cash generated by investing activities, go to the second section of the cash flow statement and either add or subtract all of the investing activities that occurred during the period, such as buying or selling shares or assets. You take the net income and add, or you can increase or decrease in penalties, respectively, and do the opposite with the income.Įnter the sum of all the adjustments made in this section on a line labeled “ Net cash from operating activities ,” and then submit it. Modifications to liabilities are the complement of adjustments made to assets.

:max_bytes(150000):strip_icc()/DDM_INV_indirect-method_final-4dc19b5d126c44ab8e1f41ea4a340170.jpg)

This step is necessary because it accounts for cash changes to liability accounts.

When making adjustments to the net income to account for cash gains and losses, asset increases should be subtracted from the income, while it should add the asset declines from the income.Īdjusting net income for cash changes to liability accounts like accounts payable and accrued expenses is the last step in the operational activities section of the cash flow statement. It indicates any financial gains or losses, including expenses, accounts receivable, and inventory on the following investment.

Create a Cash List From Cash Operating Activities: These expenses and profits include depreciation, amortization, depletion, gains or losses from asset sales and losses on accounts receivable.Ĭompile the costs associated with depreciation (the gradual decrease in value of an asset over time), and use the sum as your figure for depreciation.Ĥ. Non-cash gains, losses, or expenses should be added to or subtracted from the net income. Create a List of Non-Cash Operating Activities: It will be more transparent and precise.ģ. To display deductions, you need to enter them inside parentheses. You can record gains or losses on each cash flow from financing activities and then add or deduct the sum of those gains and losses from the net income as you go. On the first line of the cash flow statement, write the amount of the net income earned during the most recent accounting period. While the income statement details the company’s expenses and revenues, the balance sheet details the assets and liabilities of the business. You can get the information you need to draw together for a cash flow statement from the financing activities in the balance sheet and the company’s income statement. Here are the following methods to prepare the cash flow statements format indirect method:

0 kommentar(er)

0 kommentar(er)